Do you know why they show so many court scenes on TV shows and in movies involving lawyers? It’s because that aspect of lawyering is the most interesting and dramatic. In reality, being a lawyer usually involves a ton of research and bookwork done in an office setting before a case ends up going to trial; and often times, cases don’t even get that far. The process of buying a home can be similar.

When buying a home, the looking at new places and imagining your things in all the nooks and crannies is the part that yields the most fun. But, there’s a lot of work to be done before you get to that point. This point is especially true after the Dodd-Frank Act took effect in 2014 requiring that prospective homeowners provide legitimate proof that they can actually afford the home they’re looking to buy. So, what steps do you have to take before you can start shopping for a new home?

File your taxes

Lenders will always want to see your most recent tax returns to verify your income. So, if you’re home shopping in the first quarter of the year, file your taxes first. If you’re planning to file extensions with the IRS, make sure you have alternative (and recent) documents that will verify your income.

Get your financial statements in order

W-2s, previous years’ tax returns, and 1099s are going to be needed to verify your income, and it can seriously limit stress levels if you have these things handy before you’re asked for them. If you own a joint business, you’ll need a corporate tax return for the past 2 years.

Check your credit!

If you have the luxury of time, check your credit and fix anything you can at least 6-months before buying a home (though a year can be even better). You don’t necessarily have to pay anything off completely, but just make sure everything is current and that there aren’t any errors on your report.

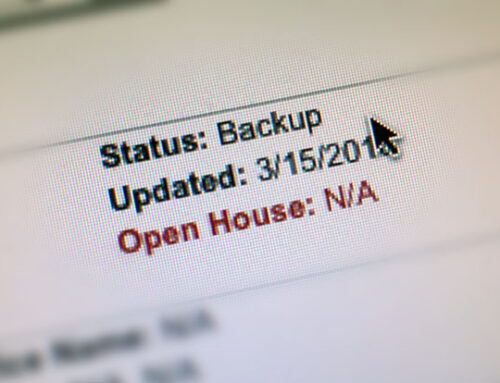

Look into the housing market

Once your finances are in order, you’ll want to start your search for a new home by checking out the market. Are home prices rising? Falling? Is now a good time to buy? How easy is it to get a loan? These are all questions you will want answers to before wading into the pool. If you’re not sure how to find answers to these questions, well, a good real estate agent will be more than happy to help you.